In the current investment climate, investors are presented with a distinct opportunity to capitalize on the evolving landscape of the senior housing sector. The 5V+ Seniors Healthcare Fund, managed by Birchwood Healthcare Partners, is uniquely positioned to harness the prevailing market dynamics, characterized by a blend of historical trends in the seniors healthcare industry and nationally emerging demographic changes.

The ten years prior to the pandemic era was marked by an oversight of supply and demand dynamics due to deal structure misalignment, as investors were drawn into the allure of easily accessible capital. The unprecedented COVID-19 pandemic placed a significant strain on occupancy levels, as senior housing facilities suspended the admission of new residents and prospective residents were hesitant to move in. The culmination of these factors, compounded by the onset of historic interest rate hikes, led to difficulties in real estate lending. While this has created unprecedented capital markets volatility, our current pipeline has identified numerous opportunities that reflect a “superfecta” investment opportunity – projecting larger returns than previously modeled at lower-level risk.

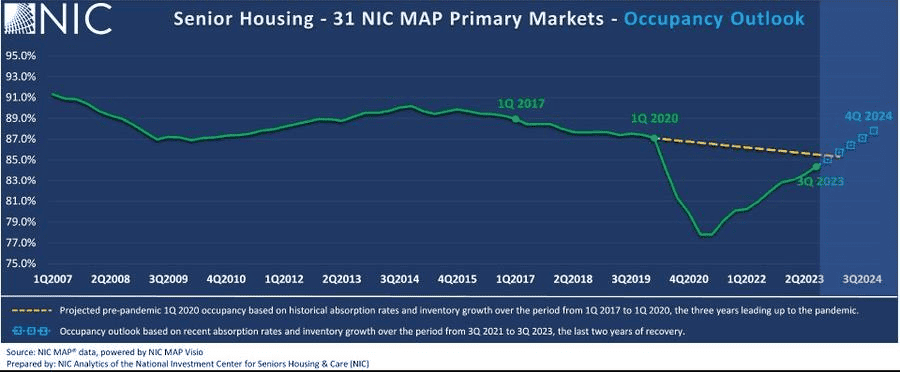

Nevertheless, the senior housing market is exhibiting signs of a robust recovery. A significant increase in occupancy levels over eight consecutive quarters, up from a low of 77.8% during the pandemic to 83.7%, signifies a sector revitalizing and adapting. Although this is yet to reach the pre-pandemic level of 87.1%, the trajectory is positive and indicative of a resilient market.

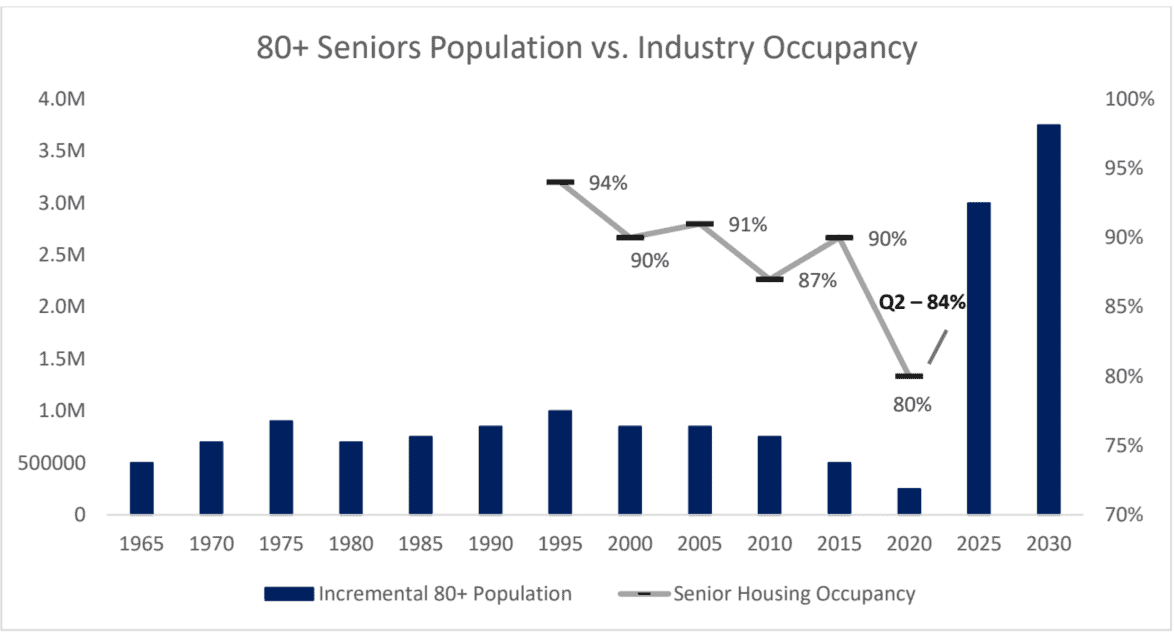

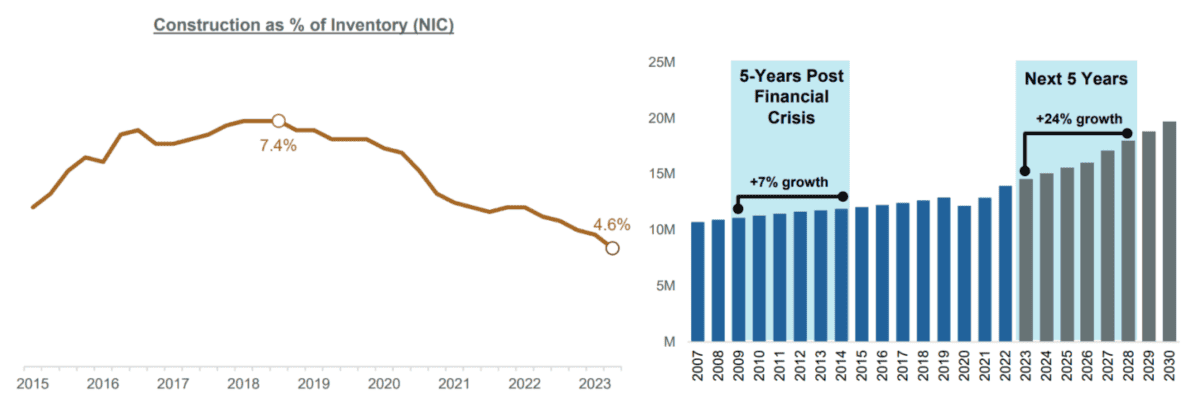

The graphs above help illustrate the upcoming supply-demand imbalance between the current 80+ seniors population and the occupancy at senior housing communities. While communities are still in the process of recovering to their pre-pandemic performance, the market has valued these assets at historically attractive low levels due to prevailing macroeconomic factors. This is occurring despite the anticipation that demand will significantly outpace supply over the coming years. This is particularly evident when considering new construction halts during the pandemic and expected growth over the next couple of years.

The CBRE 2023 Investor Survey highlights a comeback. Independent Living (IL), Assisted Living (AL), and Memory Care (MC) facilities saw a year-over-year average occupancies rising, growing investor demand, and a supply crunch. The demographic shift, marked by the “silver tsunami” of baby boomers turning 77 in 2023, is anticipated to significantly increase demand in senior housing. The next decade is expected to experience a 4.3% annual growth in the 80+ age cohort, adding over 7.3 million individuals and contributing considerably to the nation’s overall seniors population. Amidst these evolving dynamics, the 5V+ Fund offers a trusted platform as an entry point to investing in the seniors healthcare industry. The fund strategy is structured to purchase assets at a lower basis in the prevailing market, increase occupancy and revenue, and strategically reposition for sale in a cap rate compressing environment over a five-to-ten-year investment horizon.

This is further supported by an analysis of the new construction of senior housing communities, measured as a percentage of total inventory, driven by the projected growth of the 80+ population over the next five years. With construction at its lowest since 2011, due to the pandemic, availability of construction loans, labor and materials cost, and the 80+ age group set to double, there will be significant demand for existing senior housing. This investment opportunity gains further appeal when considering the industry’s notable fragmentation, encompassing roughly 25,000 facilities and 5,000 operators nationwide. There is significant disparity in the levels of sophistication among these operators. Leveraging Birchwood’s extensive industry expertise and robust relationships, the 5V+ Seniors Healthcare Fund exclusively targets the top 10% of operators at a national level.

Investors have a four-tiered opportunity for value creation, which we term the “superfecta.” It begins with purchasing assets at an attractive price, then strategically enhancing their position through operational improvements. The third step leverages growing demographic demand to boost occupancy. Furthermore, these assets are strategically positioned for a profitable sale in the near future, given the anticipated cap rate compression resulting from evolving supply and demand dynamics, and a forthcoming return to a normalized capital markets environment.

The 5V+ Seniors Healthcare Fund is a carefully crafted investment opportunity, optimized for the current market and future demographic growth. The current trends in the senior housing sector are not just about resilience; they highlight an inviting pathway for a smart, sustainable, and rewarding investment. The chance to thrive amidst these transformative times is not merely present but pressing.

Join Birchwood in making a lasting, positive impact on this industry through your participation and partnership in the 5V+ Seniors Healthcare Fund.

For investor inquiries, please contact Bill Brennan (SVP of Investor Relations) – bbrennan@birchwoodhcp.com

For acquisition and development opportunities, please contact Sean McNee (SVP & Director of Acquisitions) – smncee@birchwoodhcp.com

Isaac Dole

CEO of Birchwood Healthcare Partners