5V+ Seniors Healthcare Fund

Birchwood is one of the only fully integrated and diversified firms in the U.S. targeting the $1 trillion* American seniors healthcare industry

Fund Teaser Deck

The Problem

Given the comparatively smaller size of this industry, prospective investors lack access to aligned and sophisticated sponsors.

Other industry participants fall short of capitalizing on the tremendous market opportunity primarily due to a myopic focus and lack of evolution from antiquated investment models.

Investors have historically gravitated to structures that limit the upside for those creating value (e.g., REITs using leases), creating wide-spread misalignment in the industry.

Senior healthcare is an industry that leads with mission, vision, and values, yet investors regularly do not share those values, causing misalignment and partnership friction.

The senior healthcare sector is notorious for singular investment strategies, often forcing capital deployment into an individual segment when market conditions are not favorable.

Funds rarely span multiple layers of the capital stack, often forcing a decision to pass on an otherwise good opportunity because of inflexibility.

When investors experience any of the problems above, it's compounded by an inability to share subject matter expertise beyond internal walls.

Our Solution

Birchwood invests across the equity capital stack and throughout senior healthcare to solve the problems other funds encounter.

Birchwood focuses on and is deeply skilled at creating financial alignment among stakeholders because Birchwood's investors thrive when capital partners are incentivized.

The most important step in Birchwood's investment process is to ensure mission, vision, and value alignment, and is currently experiencing tremendous alignment success.

Birchwood's 4-vertical approach leads to deploying capital when market conditions are favorable to capture alpha.

Birchwood objectively evaluates risk and return for reach investment, utilizing variable capital tranche flexibility to suit both its fund investors' and JV* partners' best interests.

Once financial and cultural alignment exists, knowledge sharing is enabled and synergies across Birchwood's 4-verticals are amplified.

Why Invest Now With Us?

Investing in the 5V+ Fund today, enables capital deployment over the next few years; a remarkably favorable senior healthcare investment window

Relationships

The pandemic has created an urgency among institutional investors (REIT & PE), lenders and brokers to work with industry veterans as opposed to new entrants. Birchwood has longstanding deep relationships in the industry.

Construction

In 2Q22, the number of seniors housing units under construction in the 31 NIC MAP Primary Markets was the least since 2015 at 5.1% of existing inventory (it peaked at 7.7% in late 2017 and 1Q20). Birchwood is taking advantage of this dip with development strategies in 2 verticals.

Acquisitions

In 3Q22, Birchwood screened over $4 billion of investments across its 4 verticals. Birchwood's product-market fit and access to both relationships and deal flow, result in unique perspective and underwriting acumen that 5V Fund investors will benefit from.

Distress

As over $272 billion of government financial assistance programs end or wind down post-COVID, operators and properties will no longer be artificially propped up. Additionally, Birchwood expects to capitalize on these distressed investment opportunities.

Integration

The psychological profile and technology savvy of the Baby Boomers is very different than that of the Silent Generation. This coupled with government patient driven payment model and outcome-oriented care shifts, require innovation. Birchwood is at the forefront of these shifts across its verticals.

Demographic Trends

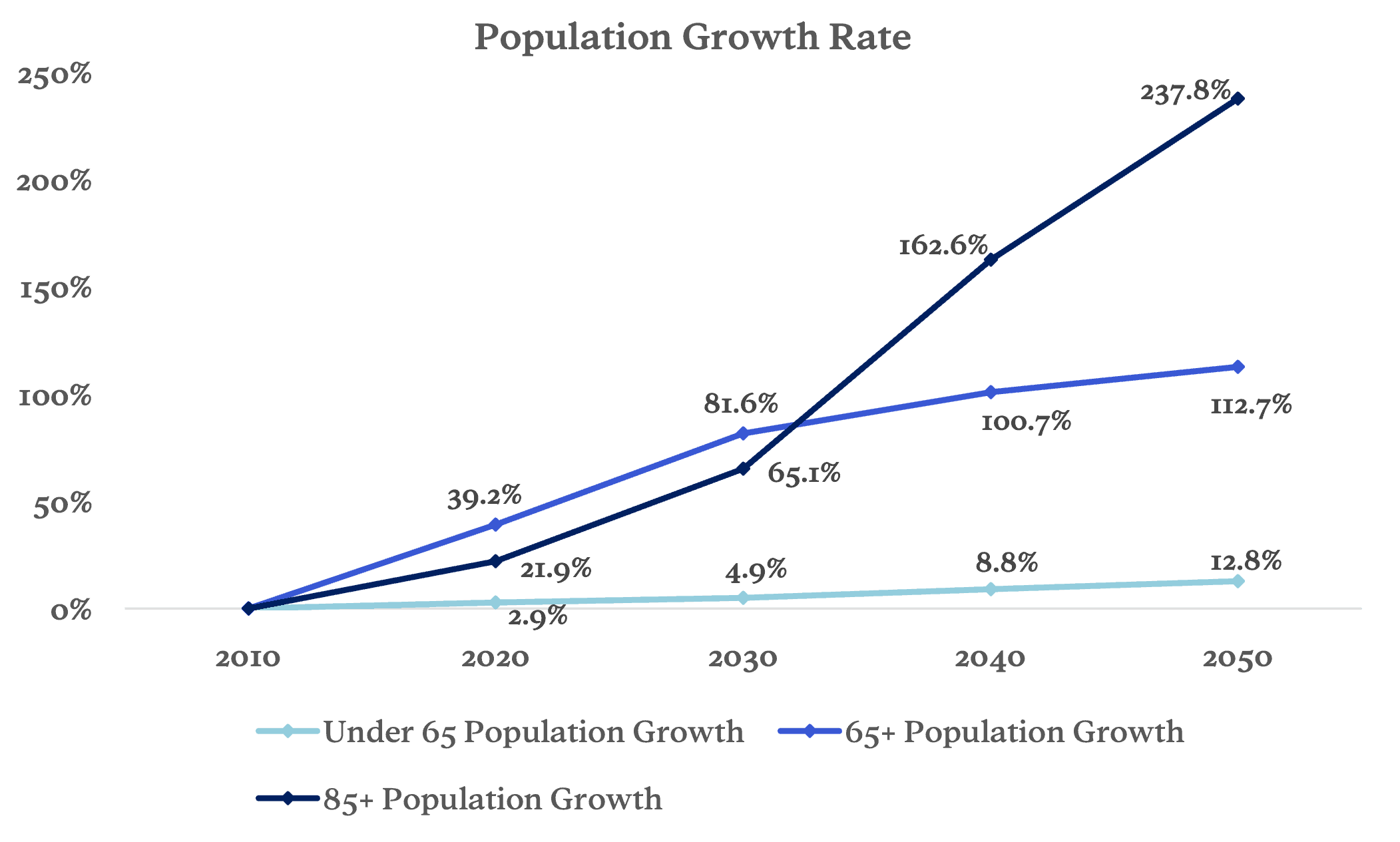

From 2010 to 2050, it is projected that the 65+ population will increase by a staggering 112%, and the 85+ age group will increase by over 237%, compared to under 13% for those under 65 years old