Now Is The Time for experienced Creative Problem Solvers with Capital

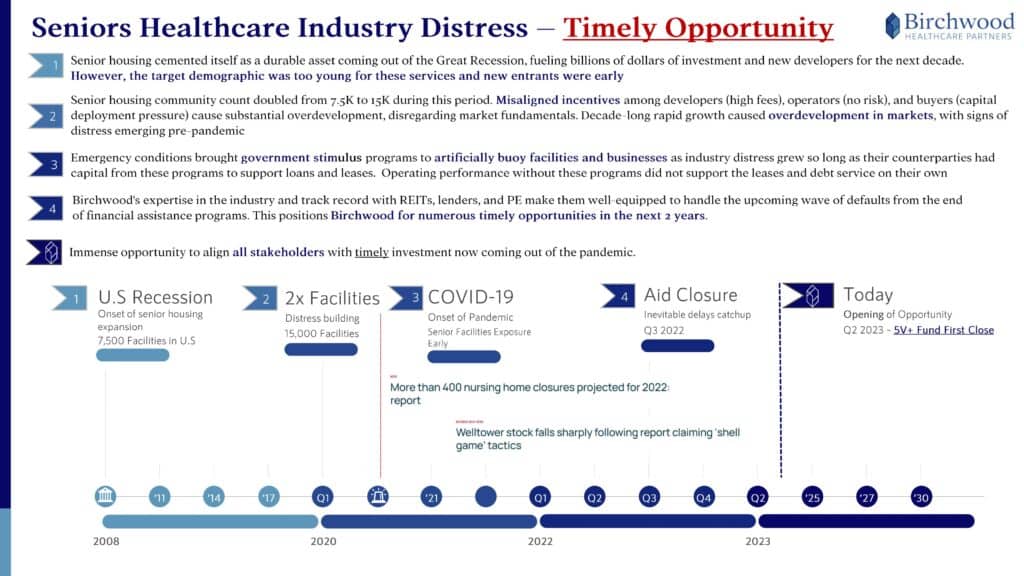

The pandemic had an unprecedented impact on the seniors healthcare industry resulting in significant occupancy decreases and cost increases. Despite these pressures, REITs and lenders extended loans and leases because their borrowers and tenants had cash from state and federal stimulus programs (PPP, Medicare Advanced Payments, Payroll Tax Deferrals and ERTCs). Now that these programs are largely behind us as an industry, REITs and lenders are facing significant defaults and loan maturities in an environment where interest rates are higher and loan proceeds are lower, materially limiting REITs, lenders and operators options on a path forward. To add pressure to the situation, occupancies and cost structures have not normalized, so margins are lower, if they exist at all.

Given these challenges, why is now an exceptional time to invest in seniors healthcare?

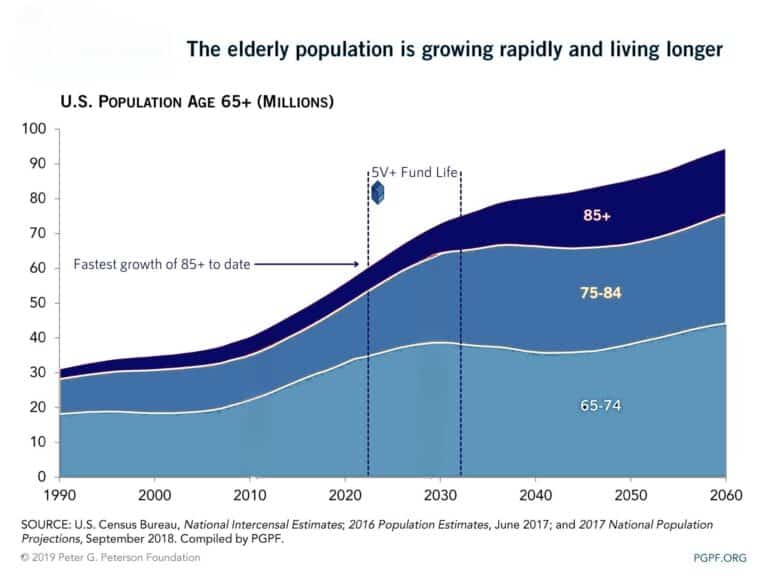

1. Demographics are finally in our favor1 – In short, those who entered the industry one to two decades ago chasing the 65+ demographic were too early. The actual average age of our residents is in the low to mid 80’s. This demographic starts to rapidly increase during the 5V+ Fund’s life starting in 2030.

2. Relationships matter – With Birchwood’s extensive relationships with REITs (and other owners), lenders and operators, combined with its diversified leadership teams, experience in each of these stakeholder roles (and therefore understand their perspective), credibility and creativity, Birchwood is uniquely positioned to help these stakeholders identify a path forward. With an excellent reputation and significant experience, Birchwood typically has an existing relationship among the stakeholders groups in many troubled situations, which immediately accelerates the depth of conversation relative to many other firms.

3. The rapid interest rate increases, combined with generally lower proceeds from lenders (and fewer active lenders), has resulted in materially lower pricing compared to just a year ago. This dynamic is compounded by the fact many investors have pulled out of the market. Speaking with brokers and sellers on a consistent basis, most are thrilled to receive one or two credible offers. Many sales processes are yielding no offers, leading to additional downward pressure on pricing.

4. Best in Class Operators Are Available – Many operators/borrowers saw the true colors of their capital partners throughout the pandemic and are now looking for better culture and vision alignment with capital partners moving forward. Further, many of the best operators in the country have capital partners and lenders who are no longer active, which leaves the door open to many of the best organizations in the industry to form new relationships.

5. Birchwood has deep and trusted relationships throughout the industry that are now leading to significant proprietary deal flow from lenders, developers, operators, REITs/PE attempting to navigate this challenging period in our industry.

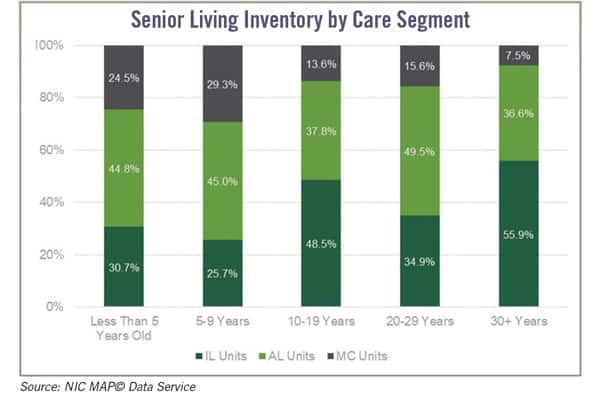

6. Due to increases in construction, labor, and debt costs over the last three years, starting construction is at an all time low, despite the significant aging of the United States over the next two decades. In addition to the above, the industry suffers from an aging building stock. Many developments in suboptimal markets or inferior sponsors have or will fall apart. Those in great markets with experienced sponsors are excellent opportunities to be one of few communities to come out of the ground in the coming months/years with little to no new competition.

Given the significant transaction volume Birchwood has completed, and the corresponding credibility and reputation the firm has developed combined with the 5V+ Seniors Healthcare Fund’s capital, Birchwood is uniquely positioned to problem solve in this environment.

We’re always looking for best in class operators, developers, investors, team members, and acquisition opportunities – contact us if creating a lasting, positive impact on seniors healthcare resonates with you.

For investor inquiries, please contact Bill Brennan (SVP of Investor Relations) – [email protected]

For acquisition and development opportunities, please contact Dave Mazurek (SVP of Capital Deployment) – [email protected]

1For more information regarding demographics, please reach out to access our data room and view our offering memorandum.

Isaac Dole

CEO of Birchwood Healthcare Partners